One of the hallmarks of estate planning is the use of terms of art in legal documents. Terms of art are often encountered in a will or revocable trust. This article will discuss the Latin phrase “per stirpes” and related concepts in the context of estate distributions to beneficiaries.

A. Per Stirpes. The term “per stirpes” literally means “by roots or stocks.” In the context of a disposition in a will or trust, the term is frequently used, for example, as part of a distribution to “surviving descendants, per stirpes.” The term is defined in New Jersey law as follows:

If a governing instrument requires property to be distributed “per stirpes,” the property is divided into as many equal shares as there are: (1) surviving children of the designated ancestor; and (2) deceased children who left surviving descendants. Each surviving child is allocated one share. The share of each deceased child with surviving descendants is allocated in the same manner, with subdivision repeating at each succeeding generation until the property is fully allocated among surviving descendants.

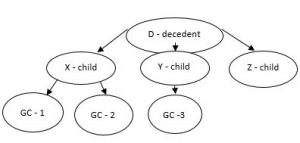

While the definition is certainly accurate, the “per stirpes” concept is most readily understood in terms of the following illustration, where D represents the decedent, X, Y and Z represent D’s children, and 1, 2 and 3 represent D’s grandchildren.

If D’s will provides that the estate is to pass to D’s descendants per stirpes, and all three of D’s children are alive, each would take a one-third interest. That’s relatively straightforward. Now, if D’s child X is deceased and Y and Z are alive, X’s children 1 and 2 would split a one-third interest, and Y and Z would each receive a one-third interest. Continuing with the various scenarios, if D’s child Y is deceased, and X and Z are alive, Y’s child 3 would receive a one-third interest, and X and Z would each receive a one-third interest. And, if D’s child Z is deceased and X and Y are alive, X and Y would each receive a one-half interest. Lastly, if X and Y are deceased, and Z is alive, 1 and 2 would split a one-third interest, 3 would receive a one-third interest, and Z would receive a one-third interest. Given the various permutations, one can understand why the term “per stirpes” is universally adopted in estate planning documents; it incorporates all of the various scenarios into a simple two-word phrase.

B. By Representation. An alternative to a “per stirpes” distribution in a will or trust is a disposition to “surviving descendants by representation” or “per capita at each generation.” The concept is similarly defined in a New Jersey statute, as follows:

If an applicable statute or a governing instrument requires property to be distributed “by representation” or “per capita at each generation,” the property is divided into as many equal shares as there are : (1) surviving descendants in the generation nearest to the designated ancestor which contains one or more surviving descendants; and (2) deceased descendants in the same generation who left surviving descendants, if any. Each surviving descendant in the nearest generation is allocated one share. The remaining shares, if any, are combined and then divided in the same manner among the surviving descendants of the deceased descendants, as if the surviving descendants who were allocated a share and their surviving descendants had predeceased the designated ancestor.

Here again, reference to the illustration will be useful to gain an understanding of the concept. One finds that in many scenarios a distribution by representation will be identical to a distribution per stirpes. For example, if D’s will provides that the estate is to pass to D’s descendants by representation, and all three of D’s children survive, each of X, Y and Z would take a one-third interest. Similarly, if D’s child X is deceased and Y and Z are alive, X’s children 1 and 2 would each split a one-third interest, and Y and Z would each receive a one-third interest. It is also the case where D’s child Y is deceased, and X and Z are alive: Y’s child 3 would receive a one-third interest, and X and Z would each receive a one-third interest. The difference becomes clear, however, if X and Y are both deceased, and Z is alive, in which case Z would receive a one-third interest and 1, 2 and 3 would divide a two-thirds interest equally among them. The critical distinction between a disposition per stirpes and a disposition by representation stems from the fact that in a per stirpes distribution, each beneficiary takes through the parent, and in a distribution by representation, every beneficiary at the same generational level receives an equal interest. To summarize, each child would take an equal interest to every other child; every grandchild receiving a share would take an equal interest to every other grandchild; and so on down the generations. Distributions by representation or per capita at each generation are often paraphrased by the expression, “equally near, equally dear.”

C. Per Capita. The last option is a disposition “per capita,” which is defined under New Jersey law as follows:

If a governing instrument requires property to be distributed “per capita,” the property is divided to provide equal shares for each of the takers, without regard to their shares or the right of representation.

In a per capita distribution, if D’s will leaves his estate to his “surviving descendants per capita,” and D’s children X, Y and Z, and D’s grandchildren, 1, 2 and 3, all survive D, then each of X, Y and Z, and 1, 2 and 3, would receive an equal one-sixth interest in D’s estate. If any of them was deceased, the others would each receive an equal one-fifth share.

Whichever option is preferred, care should be taken to be certain that the wishes of the testator are properly expressed. Otherwise, the result could be an unintended disposition of the estate, or litigation to determine the testator’s intent.

Lindabury, McCormick, Estabrook & Cooper, P.C. Firm News & Events

Lindabury, McCormick, Estabrook & Cooper, P.C. Firm News & Events